LeMaitre Vascular has announced that it acquired the assets of InaVein for US$2.5mm, or 1.1X InaVein’s 2012 sales, and potential earn-out payments in 2014 and 2015 based on the performance of the acquired business and regulatory approval in China. InaVein owned and marketed the Trivex System, a business that carried a 60–70% gross margin.

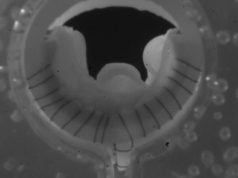

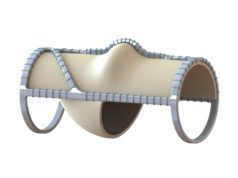

Trivex is a system comprised of capital equipment and disposables that enables less invasive removal of varicose veins. In this procedure, an illuminator instrument is inserted through a small incision into the leg, enabling visualisation of varicose veins. A second instrument removes the veins. According to LeMaitre, compared to conventional hook phlebectomy, this surgical procedure is faster and results in more complete vein removal through fewer incisions.

This acquisition introduces a new product line to the LeMaitre Vascular sales bag and builds LeMaitre Vascular’s presence in the varicose veins market. Because InaVein is a four-employee company based in Lexington, MA—less than five miles from LeMaitre Vascular’s headquarters—LeMaitre Vascular anticipates a smooth integration process.

“Trivex is a unique solution for the removal of varicose vein branches, a niche not effectively addressed through devices that focus on the greater saphenous vein. This transaction fits nicely into LeMaitre’s playbook of acquiring under-marketed devices at an attractive price, and bringing them to more potential vascular surgeon customers through the expansive reach of our direct sales force,” said David Roberts, president of LeMaitre Vascular.