Hancock Jaffe Laboratories recently announced that it has completed a public offering of its securities, generating approximately US$41.4 million of gross proceeds, prior to deducting underwriting discounts and commissions, and expenses. Proceeds from the offering will be used for general working capital purposes, including funding of the company’s proposed US pivotal trial for the VenoValve, a novel treatment for lower limb chronic venous insufficiency (CVI) of the deep vein system.

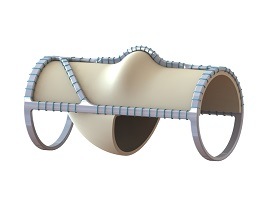

“We believe that the capital from this financing should be more than sufficient to fund the VenoValve US pivotal trial, and support the company into 2023,” said Hancock Jaffe CEO Robert Berman. “The current standard of care for deep venous CVI sufferers is ineffective and only treats symptoms, rather than the underlying structural valve issues. We developed the VenoValve to fill this large unmet medical need. With this funding, we expect to make substantial progress toward our goal of helping millions of CVI patients throughout the world.”

One-year results from the first-in-man trial for the VenoValve, released in December 2020, demonstrated significant improvement in all study endpoints, including reflux, venous clinical severity scores (disease manifestations), and visual analogue scale scoring for chronic pain, with a good safety profile. Interim results from the study were recently published online in the Journal of Vascular Surgery.

Last month, Hancock Jaffe had a successful pre-investigational device exemption (IDE) meeting with the US Food and Drug Administration (FDA) about the VenoValve and expects to file its application with the FDA in the first quarter of 2021 seeking IDE approval for commencing the VenoValve US pivotal trial.